Bitcoin Live Price vs Historical Price: What Smart Investors Analyze

Introduction: Why Price Context Matters

The bitcoin live price shows where Bitcoin is trading right now, but it doesn’t tell the full story. Smart investors look beyond the current price and compare it with historical data to understand trends, cycles, and potential opportunities.

By analyzing both live and historical prices, investors gain better insight into market behavior and reduce emotional decision-making.

What Is Bitcoin Live Price?

The bitcoin live price represents the most recent traded value of Bitcoin.

Key Features

- Updates in real time

- Reflects current market sentiment

- Useful for trade execution

It is especially important for short-term traders and active market participants.

What Is Historical Bitcoin Price?

Historical price refers to past Bitcoin prices over specific periods.

Common Timeframes

- Daily closing prices

- Monthly averages

- Yearly highs and lows

Historical data helps investors understand how Bitcoin has behaved under different market conditions.

Key Differences Between Live and Historical Price

| Feature | Bitcoin Live Price | Historical Price |

|---|---|---|

| Timing | Real-time | Past data |

| Volatility | High | Fixed |

| Purpose | Trading decisions | Trend analysis |

| Updates | Continuous | Static |

Both types of price data serve different but complementary roles.

How Investors Use Bitcoin Live Price

Short-Term Strategies

- Scalping

- Day trading

- Swing trading

Live price data helps traders enter and exit positions efficiently.

How Investors Use Historical Price Data

Long-Term Analysis

- Identifying bull and bear markets

- Recognizing support and resistance

- Evaluating growth cycles

Historical trends provide context for current bitcoin live price levels.

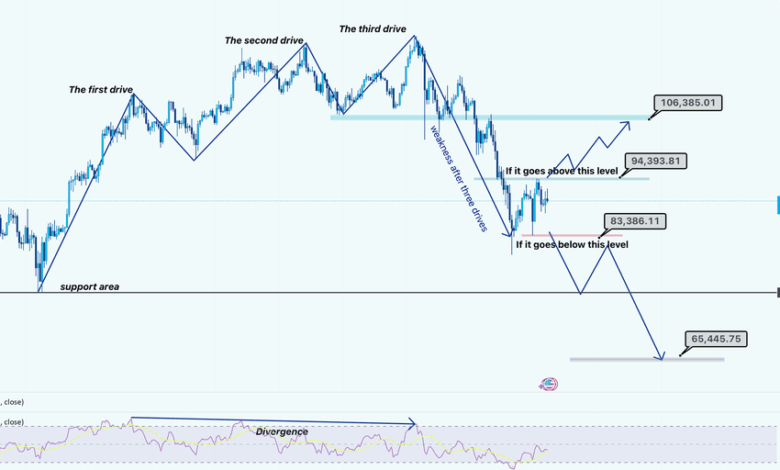

Combining Live and Historical Price Analysis

The most effective strategies use both data types.

Example Approach

- Check historical resistance levels

- Compare current bitcoin live price

- Assess risk before entering trades

This combination reduces impulsive decisions.

Bitcoin Market Cycles and Price History

Bitcoin has experienced multiple cycles.

- Accumulation phases

- Bull markets

- Corrections

- Bear markets

Understanding these cycles helps investors interpret the bitcoin live price more accurately.

Common Mistakes Investors Make

- Focusing only on live price

- Ignoring long-term trends

- Emotional reactions to short-term moves

Historical context helps prevent these errors.

Best Tools for Price Comparison

Reliable platforms for live and historical data include:

- CoinMarketCap

- CoinGecko

- TradingView

- Crypto exchanges

These tools allow easy comparison of current and past prices.

FAQs About Bitcoin Live and Historical Prices

1. Is bitcoin live price more important than historical price?

Both are important, depending on your strategy.

2. Can historical prices predict future movements?

They help identify patterns but do not guarantee outcomes.

3. Should long-term investors watch live price?

Occasionally, but long-term trends matter more.

4. Why does bitcoin live price feel expensive or cheap?

Historical comparisons provide perspective on valuation.

5. How far back should investors look at price history?

At least one full market cycle, often four years.

6. Are historical prices adjusted for inflation?

No, they reflect nominal market values at the time.

Conclusion: Balance Real-Time Data with History

The bitcoin live price offers valuable real-time insight, but it becomes far more meaningful when compared with historical price data. Smart investors use both to understand trends, manage risk, and avoid emotional decisions.

Seeing the bigger picture is essential for long-term success in Bitcoin investing.