Investment Benchmark Indicators on 934139206, 3780800, 965272863, 211501815, 958405577, 911087146

Investment benchmark indicators such as 934139206, 3780800, 965272863, 211501815, 958405577, and 911087146 play a crucial role in assessing financial performance. These identifiers provide clarity in data interpretation and enable strategic alignment with market dynamics. By understanding their implications, investors can enhance their decision-making processes. However, the complexities of these benchmarks raise questions about their true impact on investment outcomes. What insights might they reveal about future opportunities?

Overview of Benchmark Indicators

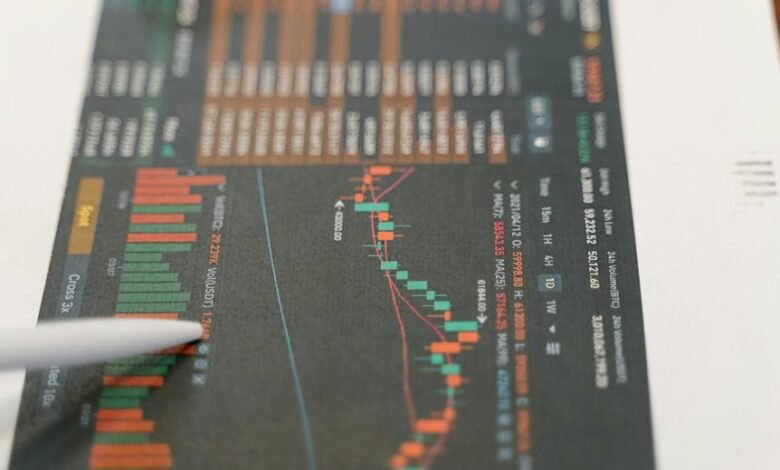

Benchmark indicators serve as critical tools in the evaluation and comparison of investment performance across various asset classes and portfolios.

They provide essential financial metrics, enabling investors to assess benchmark performance effectively. By aligning investment returns against established standards, these indicators facilitate informed decision-making, promoting a sense of financial freedom.

Consequently, they enhance the overall understanding of market dynamics and investment strategies.

Detailed Analysis of Identifiers

Investment identifiers play a pivotal role in the meticulous assessment of financial instruments and portfolios. Their significance lies in enabling accurate data interpretation, facilitating informed decision-making.

Impact on Investment Strategies

The analysis of investment identifiers not only enhances understanding of individual financial instruments but also significantly influences overarching investment strategies.

Through meticulous risk assessment, investors can refine their approaches, ensuring alignment with market conditions and personal objectives.

Additionally, insights derived from these indicators promote effective portfolio diversification, allowing for a balanced allocation of assets that mitigates risks while optimizing potential returns, thus fostering greater financial freedom.

Key Takeaways for Investors

While navigating the complexities of the financial landscape, investors should prioritize several key takeaways that can enhance their decision-making processes.

Conducting thorough risk assessments is essential, as it enables investors to understand potential pitfalls.

Additionally, staying informed about market trends can provide valuable insights, assisting in the identification of timely investment opportunities.

This strategic approach fosters informed choices and promotes financial freedom.

Conclusion

In the intricate tapestry of investment landscapes, the benchmark indicators—934139206, 3780800, 965272863, 211501815, 958405577, and 911087146—serve as guiding stars. They illuminate the path for investors, allowing them to navigate the complexities of financial markets with precision. Embracing these identifiers fosters a deeper understanding of performance dynamics, enabling strategies that not only withstand turbulence but also flourish in it. As such, these benchmarks become the quiet architects of informed decision-making and prudent risk management in the pursuit of financial prosperity.